The smart Trick of Offshore Trust Services That Nobody is Talking About

Wiki Article

Some Known Incorrect Statements About Offshore Trust Services

Table of ContentsGetting The Offshore Trust Services To WorkOffshore Trust Services Can Be Fun For AnyoneThe 5-Minute Rule for Offshore Trust ServicesSome Ideas on Offshore Trust Services You Should KnowOur Offshore Trust Services IdeasThe Of Offshore Trust ServicesOur Offshore Trust Services IdeasThe Definitive Guide to Offshore Trust Services

Exclusive lenders, also bigger personal companies, are much more amendable to resolve collections versus borrowers with complicated and effective asset protection plans. There is no property defense strategy that can hinder a very motivated creditor with unlimited money and also perseverance, but a well-designed offshore trust usually offers the borrower a desirable negotiation.Trustee firms charge annual costs in the variety of $1,000 to $5,000 annually plus hourly prices for additional services. Offshore trusts are except every person. For the majority of individuals residing in Florida, a domestic property defense plan will be as reliable for a lot less money. But also for some individuals encountering difficult creditor issues, the offshore trust is the very best alternative to protect a significant quantity of assets.

Borrowers might have a lot more success with an offshore trust fund strategy in state court than in a bankruptcy court. Judgment lenders in state court lawsuits might be frightened by overseas property protection counts on as well as may not look for collection of properties in the hands of an offshore trustee. State courts lack territory over overseas trustees, which suggests that state courts have restricted solutions to order conformity with court orders.

Offshore Trust Services - The Facts

An insolvency borrower should surrender all their possessions and legal passions in building anywhere held to the personal bankruptcy trustee. An U.S. bankruptcy court may compel the insolvency debtor to do whatever is needed to transform over to the insolvency trustee all the debtor's properties throughout the globe, including the borrower's valuable interest in an overseas trust fund.Offshore asset security trust funds are less efficient against IRS collection, criminal restitution judgments, and also family sustain obligations. The courts might attempt to urge a trustmaker to liquify a trust fund or bring back trust assets.

The trustmaker must agree to quit lawful civil liberties as well as control over their depend on possessions for an offshore depend efficiently safeguard these assets from U.S. judgments. 6. Selection of a professional and trustworthy trustee that will protect an overseas trust fund is more crucial than choosing an overseas trust territory.

The smart Trick of Offshore Trust Services That Nobody is Discussing

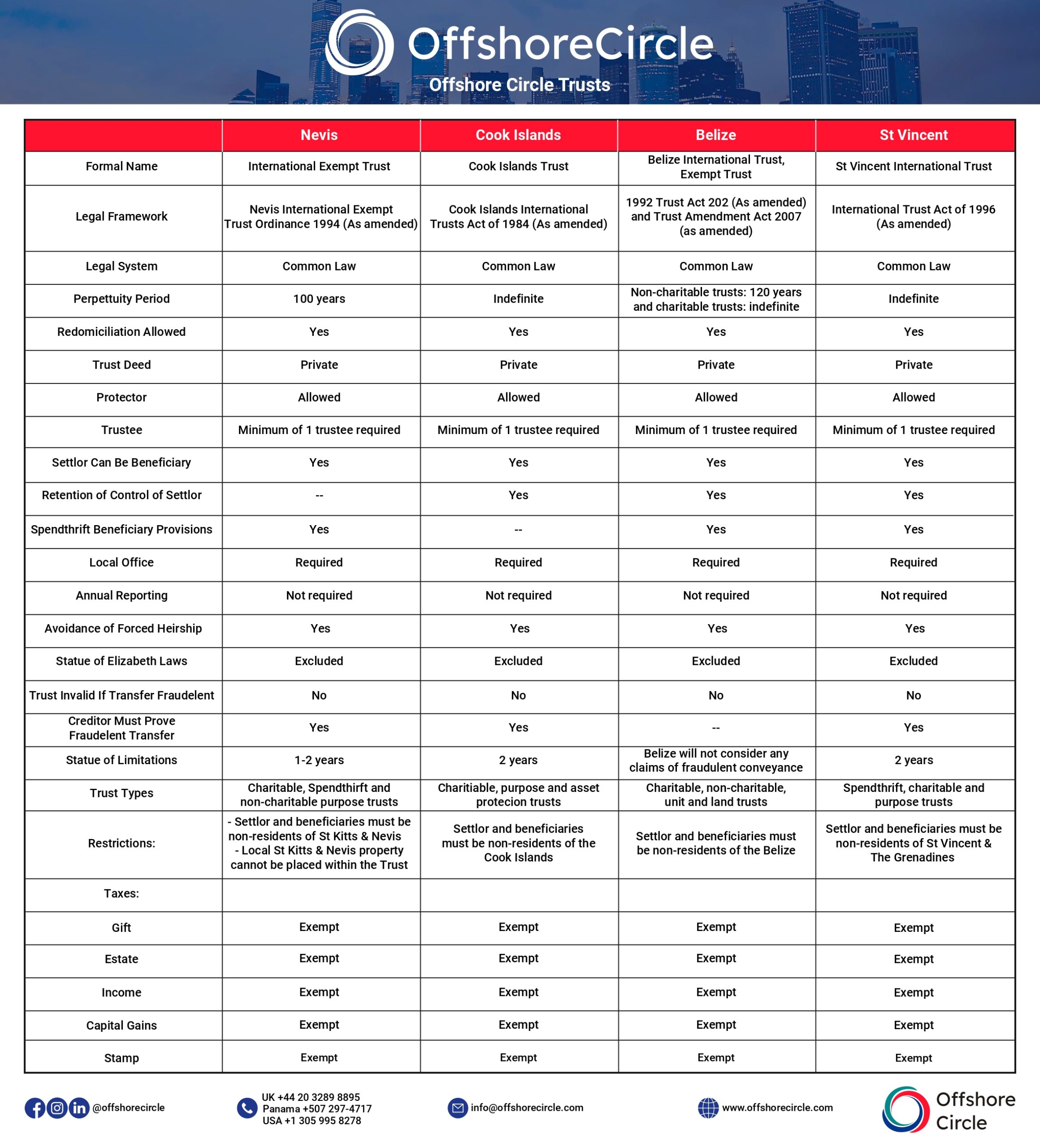

Each of these nations has trust fund laws that are positive for offshore property security. There are subtle lawful differences amongst offshore trust territories' laws, yet they have extra features in usual. The trustmaker's choice of country depends mostly on where the trustmaker feels most comfy putting assets. Tax obligation treatment of international offshore depends on is very specialized.

Official data on depends on are challenging to come by as in a lot of offshore jurisdictions (and in the majority of onshore territories), counts on are not required to be signed up, however, it is assumed that the most typical use of overseas counts on is as part of the tax obligation as well as financial preparation of rich individuals and their households.

The Definitive Guide for Offshore Trust Services

In an Unalterable Offshore Depend on may not be altered or liquidated by the settlor. An allows the trustee to pick the circulation of revenues for various courses of beneficiaries. In a Set count on, the circulation of income to the beneficiaries is taken care of and also can not be changed by trustee.Privacy and also anonymity: In spite of the reality that an offshore depend on is formally registered in the federal government, the parties of the count on, possessions, and the problems of the trust fund are not tape-recorded in the register. Tax-exempt standing: Assets that are transferred to an overseas trust fund (in a tax-exempt overseas zone) are not tired either when transferred to the trust, or when moved or rearranged to the recipients.

The 5-Minute Rule for Offshore Trust Services

This has actually likewise been carried out in a variety of U.S. states. Count on basic are subject to the policy in which gives (briefly) that where trust residential or commercial property includes the shares of a firm, then the trustees need to take a favorable duty in the affairs on the firm. The regulation has been criticised, however stays component of trust law in numerous typical legislation jurisdictions.Paradoxically, these specialist kinds of trusts seem to rarely be utilized in connection to their original designated uses.

Particular territories (especially the Chef Islands, however the Bahamas likewise has a types of asset defense count on) have actually supplied unique trusts browse this site which are styled as property protection depends on. While all trusts have an asset protection element, some jurisdictions have actually passed laws trying to make life difficult for lenders to press insurance claims versus the trust fund (for example, by supplying for specifically short restriction durations). An offshore trust fund is a tool made use of for asset defense and also estate planning that functions by transferring possessions right into the control of a legal entity based in another nation. Offshore counts on are unalterable, so depend on proprietors can not reclaim possession of transferred possessions. They are likewise made complex and pricey. For people with better obligation concerns, offshore counts on can give security as well as greater personal privacy as well as some tax benefits.

Get This Report on Offshore Trust Services

Being offshore adds a layer of defense and personal privacy in addition to the capacity to manage tax obligations. Due to the fact that the trust funds are not located in the United States, they do not have to comply with United state laws or the judgments of United state courts. This makes it much more hard for lenders as well as plaintiffs to go after cases against assets kept in offshore trust funds.It can be challenging for third celebrations to establish the properties and owners of overseas depends on, that makes them aid to personal privacy. In order to set up an overseas trust, the initial step is to select an international nation in which to locate the depends on. Some popular areas include Belize, the Chef Islands, Nevis and Luxembourg.

Not known Factual Statements About Offshore Trust Services

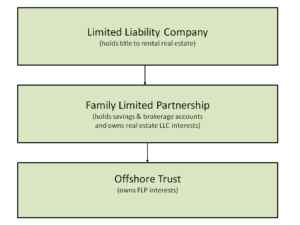

Transfer the properties that are to be secured into the trust fund. Count on owners might first create a limited responsibility business (LLC), transfer properties to the LLC and then transfer the LLC to the trust. Offshore counts on can be helpful for estate planning and asset defense yet they have constraints.people that establish overseas trust funds can not escape all taxes. Revenues by properties have a peek at this site put in an overseas count on are without U.S. tax obligations. But united state residents that get distributions as beneficiaries do have to pay U.S. revenue tax obligations on the circulations. U.S. proprietors of offshore trust funds likewise need to file records with the Irs.

Excitement About Offshore Trust Services

Corruption can be a concern in some nations. Furthermore, it is very important to choose a nation that is not likely to experience political agitation, regimen change, financial upheaval or quick modifications to tax plans that can make an overseas count on less beneficial. Property security trusts usually have actually to be developed before they are required.They likewise don't flawlessly shield against all claims and also may reveal owners to risks of corruption and also political instability in the host countries. Nonetheless, overseas counts on are helpful estate planning and asset protection devices. Comprehending the correct time to use a details trust fund, and also which trust would certainly provide one of the most benefit, can be complicated.

An Offshore Count on is a traditional Count on shaped under the laws of nil (or low) tax Global Offshore Financial. A Trust fund is an authorized strategy (similar to an arrangement) where one individual (called the "Trustee") according to a subsequent person (called the "Settlor") consents to acknowledge and hold the residential or commercial property to assist various individuals (called the "Recipients").

Report this wiki page